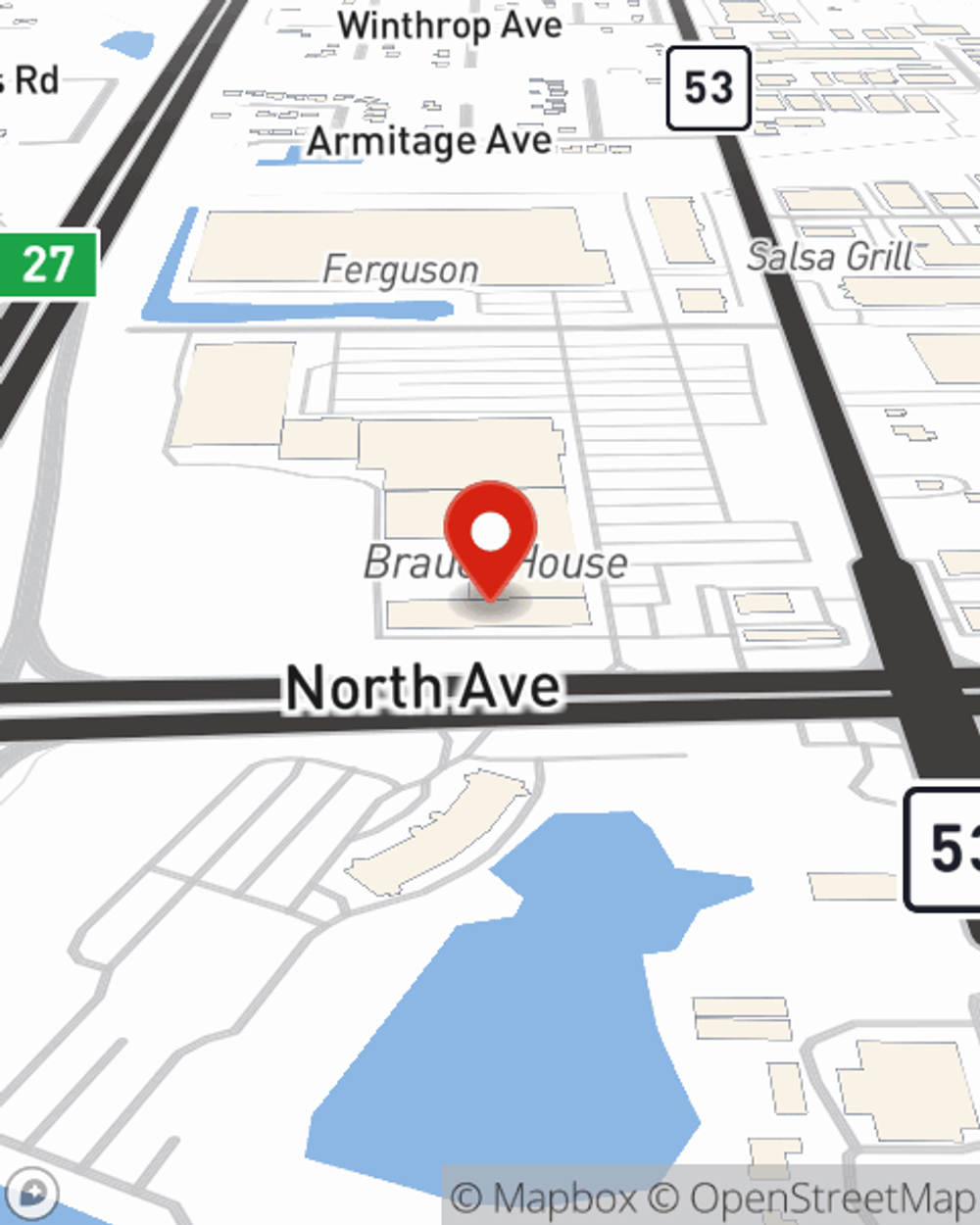

Business Insurance in and around Lombard

One of Lombard’s top choices for small business insurance.

Insure your business, intentionally

- Lombard

- Addison

- Glendale Heights

- Oakbrook

- Carol Stream

- Naperville

- Lisle

- Woodridge

- Glen Ellyn

- Villa Park

- Plainfield

- Aurora

- Wheaton

- Arlington Heights

- Schaumburg

- Elmhurst

- Bloomingdale

- Wood Dale

- Roselle

- Elk Grove Village

- Winfield

- Downers Grove

- Bolingbrook

- Darien

Coverage With State Farm Can Help Your Small Business.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected loss or accident. And you also want to care for any staff and customers who stumble and fall on your property.

One of Lombard’s top choices for small business insurance.

Insure your business, intentionally

Keep Your Business Secure

With options like a surety or fidelity bond, business continuity plans, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Ryan Horan is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does happen.

Take the next step of preparation and contact State Farm agent Ryan Horan's team. They're happy to help you research the options that may be right for you and your small business!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Ryan Horan

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.